Q3 2025 Market Perspective

- Claudia Deras, CFP®

- Jul 24, 2025

- 5 min read

Updated: Oct 14, 2025

Following the election, many of us have been focused on upcoming policy changes and their anticipated effects. Economists and politicians alike have weighed in on the rationale behind these policies and the potential outcomes that might result if they materialize. Among the key topics dominating the headlines are tariffs and the One Big Beautiful Bill. While higher taxes on imports have been discussed for months, the trade deals remain in the works. Many are concerned about the potential implications that higher tariffs may have on the US economy, as economists forecast a possible increase in inflation. Fortunately, the economy remains solid, although interest rates continue to be elevated, adding another layer of complexity for the Federal Reserve to determine when it can implement its first rate cut. Despite the sharp downturn we saw from March to early April, the market rebounded, with the S&P hitting an all-time high.

The first half of the year has taught many investors two lessons: first, changes in the economy do not necessarily lead to a one-to-one correlation with changes in the stock market, despite their strong historical correlation. Secondly, diversification and time in the market will always reward investors. In addition to the latter, it is essential to regularly review your investment allocation to ensure it remains aligned with your evolving needs and goals.

Inflation & Interest Rates

During the June Federal Open Market Committee (FOMC) meeting, the Federal Reserve maintained its interest rate at the current level of 4.25%-4.5%. Additionally, they announced two rate cut projections by the end of this year, along with a summary of economic projections. Though inflation has come down, the Federal Reserve adjusted its projections for the end-of-year PCE (Personal Consumption Expenditures) and Core PCE (Excludes food and energy) at 3% YoY and 3.1% YoY, respectively, .3 percentage point higher than their March Projections.

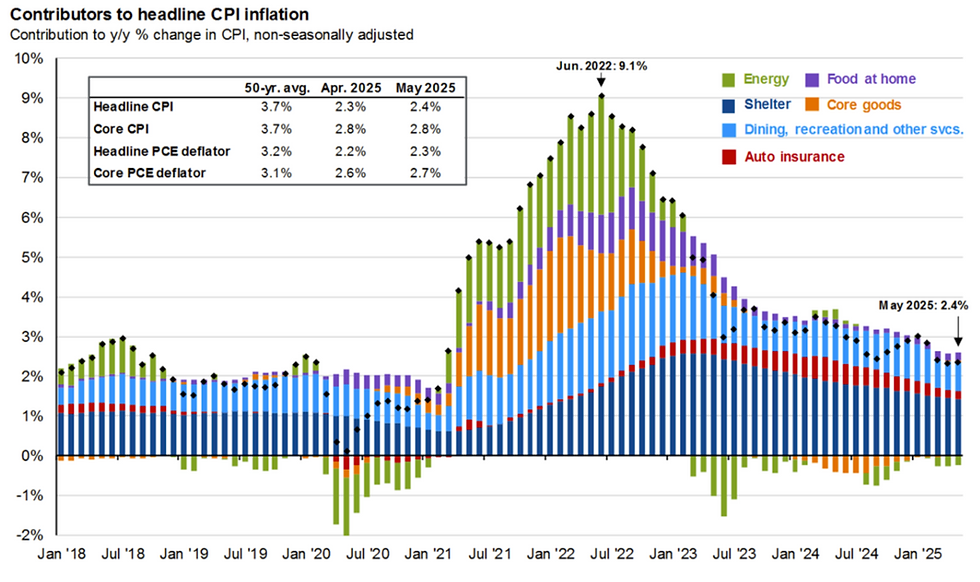

The Consumer Price Index, another measure of inflation, has been trending downward since June 2022. The chart below illustrates the composition of the CPI and the areas that have experienced the most significant decreases. Although most areas are trending

downwards, auto insurance, shelter, and discretionary services have failed to make more progress. Despite the uncertainty of tariffs, inflation has remained below 3% with the most recent report showing an uptick to 2.7% YoY (Year-over-year) for the month of June, and the unemployment rate came .1 percentage points lower at 4.1% YoY.

Forecasts indicate that inflation may continue to rise as tariffs take effect; however, if economic growth remains steady, rate cuts may be unlikely this year.

Tariffs

President Donald Trump referred to April 2nd as a “Historic day in American history”. On Liberation Day, Trump announced a 10% tariff on all imports. Within days, Trump

announced a 90-day pause on tariffs, excluding China. In the following months, most discussions focused on negotiations and attempts to reach trade agreements. Despite the Federal Court blocking some tariffs on a few of our largest trading partners on May 28th, tariffs on steel and aluminum doubled to 50% on June 4th, with the exception of the UK.

As the 90-day pause came to an end, President Trump announced he had sent letters to multiple countries outlining the tariff rate he would impose if they did not reach a trade agreement by August 1st.

As seen in the chart above, Brazil topped the list with the highest tariff rate of 50%, which is 40 percentage points higher than the previously announced rate of 10%. Seeing these high tariff rates could be a cause for concern, as economists forecast that the economy could tip into a recession once they are implemented. Unexpectedly, the markets have tuned out the noise and have continued to rally since the dip ended on April 8th.

Market Overview

The markets were sent into a spiral after “Liberation Day” was announced. From April 2nd to April 8th, all major U.S. indices declined by more than 10%. On April 9th, when the 90-day pause was announced, markets rallied with the S&P 500 hitting an all-time high once again towards the end of June. International markets, on the other hand, have outperformed US markets. With a falling dollar and uncertainty in US policy, investors

have turned to foreign countries for opportunities.

In terms of sector performance, Communication services, Industrials, and Technology have over performed most sectors, including the S&P 500, during the first half of the year. This performance continues to be driven by the growth in AI, but caution is advised as investors remain invested in these sectors.

The outlook for the second half of the year remains positive, but higher volatility is anticipated as the impact of tariffs unfolds. Healthcare is one of the sectors most likely to be heavily affected, partly due to proposed tariffs on pharmaceuticals from China and the Medicaid cuts introduced in The One Big Beautiful Bill.

Due to the increased uncertainty caused by tariffs, we believe that diversification plays a significant role in clients’ portfolios, helping to mitigate some of the unforeseen macro and geopolitical risks.

CWM Portfolios

Corinthian’s approach to investing employs a combination of strategies to meet our clients' investment objectives. Ultimately, the key to successful investing is being patient and disciplined. Throughout the first and second quarters, we have been rebalancing our portfolios to align with our clients’ investment profiles. At a global level, we’ve added some international exposure. Portfolios with a higher risk profile tend to have a greater tilt towards growth. For the fixed income portion, we continued to remain invested in short- to mid-duration bond funds, earning an attractive yield. We will continue to assess the market and economic environment, making appropriate adjustments as needed. As always, nothing is constant, and the best way to navigate the markets is by remaining adaptable and flexible.

Corinthian is your partner when it comes to your finances. We are a resource when you have questions. If you would like to know how something will impact your financial situation, please get in touch with your primary advisor at (408) 995-0915.

Advisory services offered through Corinthian Wealth Management, Inc. a Registered Investment Advisor.

Sources

Board of Governors of the Federal Reserve System. (2025, June 18). FOMC economic projections table. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250618.pdf

J.P. Morgan Asset Management. (2025, June 30). Guide to the Markets: 3Q 2025. https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

Wattles, J. (n.d.). A timeline of Trump’s tariff threats and actions. CNN Business. Retrieved July 17, 2025, from https://www.cnn.com/business/tariffs-trump-timeline-dg

Reuters. (2025, July 12). Trump announces 30% tariffs on EU goods. https://www.reuters.com/business/trump-announces-30-tariffs-eu-2025-07-12/

MarketWatch. (n.d.). S&P 500 index chart. Retrieved July 17, 2025, from https://www.marketwatch.com/investing/index/spx/charts?mod=mw_quote_advanced

Trading Economics. (n.d.). United States Inflation Rate (CPI). Retrieved July 17, 2025, from https://tradingeconomics.com/united-states/inflation-cpi

Goldman Sachs. (2025, July). S&P 500 projected to rally more than expected. https://www.goldmansachs.com/insights/articles/s-and-p-500-projected-to-rally-more-than-expected

CFRA Research. (2025, July 7). Q2 2025 EPS outlook: Sector watch.

Kleintop, J., & Gibley, B. (2025, June 6). Mid-year outlook: International stocks and economy. Charles Schwab. https://www.schwab.com/learn/story/mid-year-outlook-international-stocks-economy

.png)

Comments